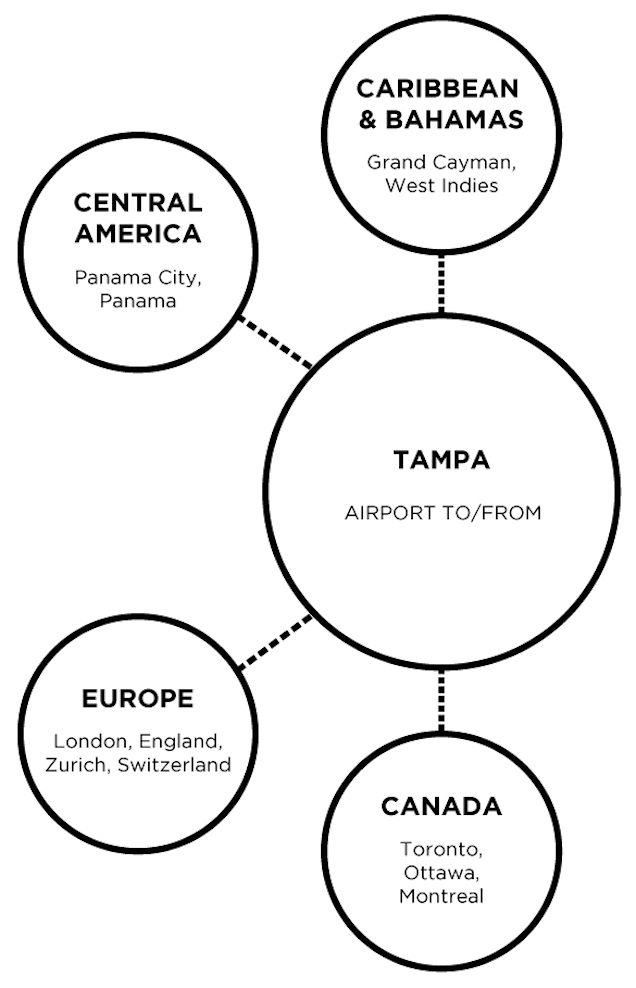

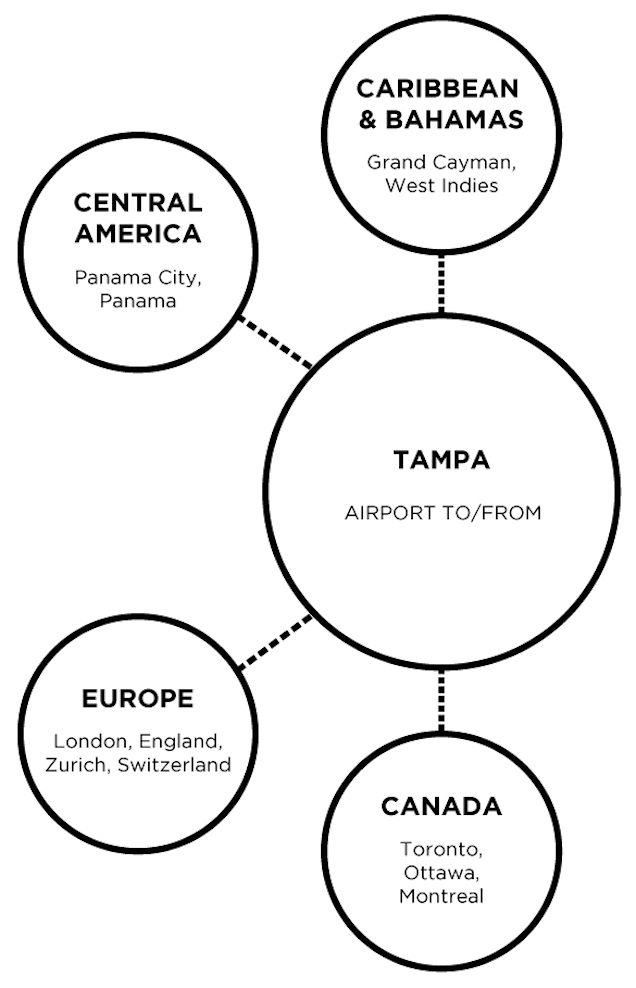

International Flights to and from Tampa Florida

Call (941) 587-0740

Fortunately for the global real estate investor eyeing up a piece of Florida real estate, there are no restrictions on foreigners purchasing and owning real estate in the U.S.

However it’s up to the purchaser to determine if their home country puts any restrictions on buying abroad – it’s worth really investigating this as some countries can discourage foreign investment outside their own shores, through punitive taxes on purchasing real estate abroad, or restricting the amount of time residents can spend outside of their home country without losing residency rights.

Many people choose Florida property as an investment, either for split residency for part of the year, as an income-generating rental, or as a future retirement property. In all these scenarios it is very important to check any restrictions that may be in place in your home country whether via taxes, financial, or visas.

It’s worth noting that buying real estate in the USA is one of the safest investment destinations you can choose. All real estate transactions are protected by U.S. contract law, and the use of escrow as a standard protects your money while a transaction is in progress.

If you invest between 500,000 and a million dollars in a U.S business enterprise you can get a green card via the EB-5 Investor Visa, which means you have the legal right to work and reside in the U.S. as long as you file U.S. income taxes.

For all those without that kind of cash to flash, there are a variety of visas that should suit your purposes. Check all the opportunities which may be available to you with an immigration lawyer, to make sure you’re making the right choice.

If you just use the home as a vacation residence the likelihood is you won’t even need a visa for a short-term visit under 90 days. For visits over 90 days, there are myriad visa choices available.

No. It’s advisable to view your property in person, but if you choose not to, your agent can act on your behalf for this part of the deal. And when it comes to closing, you don’t need to be present, you can either give ‘Power of Attorney’ to a representative who can close the deal for you, or nowadays more and more real estate sales are being closed by mail, with all the documents being signed abroad and mailed back to the U.S.

If you are signing the papers in your own country, you don’t need to give power of attorney, and we have even had cases of lawyers traveling abroad to witness the signature. Please refer to our section on closing in our book for more information More and more people are buying property “sight unseen” relying on virtual internet tours, photography, map programs, and more.

We prefer that our clients have visited the property in question. A client we had recently had his heart set on a particular property which seemed like a great deal. Only when we viewed it together in person was he able to get the full effect of the property’s location, directly in the flight path, loud and in stereo. We do always highly recommend that you visit the property in person.

All Florida property owners pay tax based on the assessed value determined by the local municipality, which is directed by Florida statute. However, the benefits of Florida tax laws far outweigh the negatives in our opinion.

There is no sales tax on property purchases, and if you earn money in the state of Florida (for example rental income on an investment property) there is no personal state income tax, which is a huge bonus and incentive for a lot of people choosing to live or buy property here.

Again, depending on how long you intend to stay in the U.S., you may qualify to be covered by travel health insurance from your own country. For longer-term visits/split residency there are multiple options at affordable rates.

Schedule a free 20 minute Sarasota Real Estate Orientation by choosing a day in the sidebar.

This morning I visited some of Sarasota’s most popular destinations — St Armands Circle, the Unconditional Surrender statue at the Downtown Bayfront, and Siesta Key Beach. I want to demonstrate that whether someone wants to shop and eat, take pictures, or recreate on the beach, life for residents and visitors here in Sarasota continues — even though 2020 has been tumultuous.

There is always a lot of press about the Sarasota real estate market. The main headlines right now continue to be about “Low Inventory.” However, I think the deeper story is “What is Selling.”

Yet not all properties are selling equally. Today’s buyer is eyeing the big bowl of juicy fruit that is our real estate market and they are choosing the ones that are just right. So, sellers in the same building — or even the same street — may be having different experiences based on the orientation of the views, condition of the property, and listing price.

The local unemployment rate was down to 5.6% in September and Florida’s consumer confidence was up slightly to 84.4% This is a fair number, certainly higher than what it was a few months ago.

For me, one of the best leading indicators of the real estate market is the Ultra Luxury Market. These are properties listed for $3M or more. It has been very, very healthy with hundreds of properties sold in the past few months and many more closings set in the next several months. I see this as validation in both our community and the local real estate market.

We do not have panic buying, rather we are experiencing that our local real estate is comfort food for uncertain times.

If you want to taste, or to clear your plate to try something new, let me know (941.587.0740).

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) establishes that persons purchasing U.S. real property interests from foreign individuals must withhold 10% of the gross amount realized on the transaction. This rate will be increased 50% effective February 17, 2016 from the previous 10% to 15%.

Because the rules for withholding can be cumbersome to understand, it is advisable as always, to take legal or accountancy advice to make sure you comply. It is always better to spend the money upfront to make clear what you need to do, rather than deal with any unintended consequences from simply not knowing how it works.

That said, we think it is important to present the information here as clearly as possible in order to familiarize you with the rules and how they apply.

Like many countries, one of the ways the U.S. Government generates its income is by taxing the profits on the sale of real estate investments made within the country. This is a type of capital gains tax, which applies to citizens and non-citizens alike, who sell investment property (the sale of a primary residence is handled differently).

Like many countries, one of the ways the U.S. Government generates its income is by taxing the profits on the sale of real estate investments made within the country. This is a type of capital gains tax, which applies to citizens and non-citizens alike, who sell investment property (the sale of a primary residence is handled differently).

U.S. citizens are subject to this tax as part of their regular income tax. For global buyers, The Foreign Investment in Real Property Tax Act (FIRPTA) is the mechanism that sets the parameters for handling the payment of taxes for foreign persons who sell U.S. real estate interests.

Essentially, when an individual sells a property in the United States, they are required to file a U.S. income tax return to report the sale. This is where the actual tax on the sale is calculated.

FIRPTA requires that any individual who is selling a property in the U.S. that is not a U.S. citizen will have 15% of the gross sales price withheld at closing. This 15% withholding must then be remitted to the Internal Revenue Service (IRS) within 20 days after closing.

This 15% withholding is considered a deposit that will be applied to the actual tax which is calculated when filing a U.S. income tax return. Upon comparing the deposit and the actual tax, if the tax is less than the 15% withholding, the remainder is refunded to the seller. If the difference is greater than the 15% withholding, the seller must then remit the balance to the IRS.

No withholding is required provided that the sale price is $300,000 or less and the buyer (including family members) intends to use the property as a personal residence for at least 50% of the time it is in use for a period of 24 months after closing. Days that the property is not in use are excluded from this 50% calculation.

For this to apply, the buyer must be an individual as opposed to a corporation, estate, trust, or partnership. Vacant land is not eligible for this exemption even if the buyer intends to build a residence on the property.

As an example, let’s consider that a foreign citizen sells a U.S. property for $285,000. In this example, the buyer intends to use the property as a personal residence for five months out of the year on an ongoing basis. The buyer also intends to rent the property for three months out of each year. During the remaining four months of each year, the property will remain vacant.

Because the buyer intends to use the property as a residence for five out of the eight months that the property is in use during a twelve-month period and the buyer intends to continue this pattern for more than the required two years, the 50% calculation will be met and the seller qualifies for the exemption.

In this example, however, the buyer must be willing to sign an affidavit as to their intentions under penalties of perjury. The seller must still file a U.S. income tax return reporting the sale and pay all applicable income taxes.

Sales exceeding $300,000, whether at a profit or at a loss, do not qualify for an exemption.

The 15% withholding rate may be reduced back down to the prior 10% rate provided that the sale price does not exceed $1,000,000 and, as with the exception above, the buyer intends to use the property as a personal residence as described. In this case, as well, the buyer must sign an affidavit under penalty of perjury expressing their intentions.

Another important piece of information to keep in mind is that, when the actual tax on the sale is significantly less than the 15% withholding, the seller can apply for a withholding certificate from the IRS. This, then, allows for a reduction in the amount withheld at closing from 15% down to 10% of the gross sales price.

To clarify why this is crucial, let’s look at another example. An individual bought a property for $700,000. He is later only able to sell the same property for $600,000. In this case, because the seller is incurring a significant loss on the sale of the property, no income tax is payable on the sale. Still, the 15% withholding is applicable and $90,000 will be withheld on the transaction.

However, in this situation, the seller may submit an application to the IRS documenting that the sale will result in a loss. Provided that the application is made no later than the date of closing, no withholding is required.

Because it generally takes the IRS 90 days to issue the withholding certificate, the closing may take place before the certificate is issued. If this is the case, the 15% is deducted at closing. However, instead of remitting the withholding to the IRS, the closing agent is able to hold the money in escrow until the withholding certificate is issued. Upon receipt of the certificate, the agent is then able to remit the reduced withholding amount, if any is applicable, and return the balance to the seller.

Things to consider in deciding to apply for a withholding certificate are how the actual tax compares the withholding amount and the time of year that the transaction takes place. Individual income taxes are reported based on the calendar year.

Things to consider in deciding to apply for a withholding certificate are how the actual tax compares the withholding amount and the time of year that the transaction takes place. Individual income taxes are reported based on the calendar year.

There is less reason to file for the withholding certificate if the sale takes place in December and the tax return may be filed in the near future. In this case, the funds would be refunded a few months after the sale.

However, if the sale takes place in January, it could be 14 months or more after the sale before the refund is issued. In this case, depending on the amount due, it may be advisable to apply for a withholding certificate.

In considering the terms of a short sale, where the amount due on the existing mortgage will not be met from the proceeds of the sale, the 15% rule still applies on a property with a sale price over $300,000. In this case, it would be advisable to apply for the withholding certificate as any withholding would reduce the amount paid to the lender at closing. Without it, it is unlikely that the lender would approve the sale.

In order to apply for a withholding certificate, all parties involved in the transaction must have a Tax Identification Number (TIN) or a U.S. Social Security Number. This is extremely relevant for the Foreign Investor because it provides for the opportunity to obtain a U.S. TIN. The only other way for a Foreign National to get a TIN is by renting their property.

To find out more about FIRPTA visit:

https://www.irs.gov/Individuals/International-Taxpayers/FIRPTA-Withholding

To find out more about Tax Identification Numbers visit:

https://www.irs.gov/Individuals/International-Taxpayers/Taxpayer-Identification-Numbers-TIN

The period of time from the day you sign the contract to the day you close on your new Sarasota property can be both exciting and hectic. Closing on a house or condo is always a big day! Here we go over what you need to know, what details and loose ends need to be taken care of, and what to expect at closing to ensure that you are ready to take ownership of your new Sarasota property.

Ideally, closing on your new Sarasota home should be a formality. The documents are signed, the monies exchanged for the keys, hands are shaken and off you go. Because it isn’t always an ideal world, a good Realtor should take the time to prepare you for what to expect so that your closing day goes as smoothly as possible.

Prior to your closing on a house, you should review all of the documents you will be signing, make sure all of your paperwork is in order, the utilities are turned on and that your money is accessible to complete the purchase. With the following five tips, you should be as ready as you can be!

As you move forward in the process your Realtor, Closing Agent, and Mortgage Broker (if applicable) will advise you of the costs for purchasing the property. Many of the costs involved are fixed costs based on either the US Dollar amount of the transaction or the size of the property, either land or structure.

One instance of fixed cost is taxes on the transfer of property from one person to another, in this case from the seller to the buyer. Taxes on transfer also referred to as document stamps, are a fixed rate for any property, at .07 cents per hundred dollars.

So, for example, on a $100,000 home, it would come to $700. This is usually paid by the seller but can be a negotiation point. This tax rate is set by the State of Florida.

All of these purchasing costs are one-time fees that are part of completing the transaction. When you are financing (receiving a mortgage), your purchasing costs are a bit higher than when paying cash.

In order to cover the purchasing costs (inspections, survey, title, appraisal, legal fees, title insurance premiums, taxes on transfer, recording fees), and mortgage taxes and fees (if applicable) you should estimate spending between one and three percent of the purchase price.

It is interesting to note that we recently had a transaction involving a family from the UK. Due to the volatility of the British Pound in the spring of 2016, they decided to lock in a forward contract with a currency trader. This protected them in the event that the pound moved lower against the dollar which would have decreased their buying power.

The closing statement is essentially a document that itemizes all of the expenses of the transaction. It is a complete reflection of the credits and debits involved in the sale.

This closing statement acts as a reconciliation of all monies flowing between Seller, Buyer, and any 3rd-party vendors that will be paid via the closing statement. This form also simplifies the process for you as the Buyer so that you only have to transfer one lump sum.

The closing agent must provide you as the buyer the closing statement 3 business days prior to closing.

In 2015 there was a second closing statement introduced that is used when someone receives bank financing. Both forms perform the same accounting reconciliation function. The new form for financing, called the Closing Disclosure (known as TRID), also includes sections for interest rate, repayment amount, etc.

The bottom line is that both forms explain all of the settlement costs, and who pays whom, in detail. It will let you, as the buyer, know exactly how much money you need to bring to closing.

Click on the links below for PDF examples of these documents:

Closing Statement (Cash Purchase)

Closing Disclosure (TRID — Used in Financing)

The following are things that need to be in place prior to closing because the day of closing on a house belongs to the Buyer. This means that all expenses related to the property will be charged to the Buyer on this day forward including electric, water, property taxes, and insurance.

In a cash closing, the buyer must bring to closing the difference between the amount he/she put down as a deposit and the purchase price, as well as any outstanding purchase or ownership costs that are due at closing.

If the buyer is financing, this number is the purchase price and purchase costs, less the initial deposit(s) and amount of the mortgage. Typically the balance is paid via wire transfer, though some buyers still opt for a certified check.

For proof of insurance, you will need a letter or statement showing you have taken out homeowners’ insurance on the property. This is required by the lender. This must be handled in advance of the closing date as the policy has to be in place on the day of closing.

Typically, this is coordinated between the mortgage broker/lender, closing agent, and insurance broker. Property insurance is not required in Florida if you pay cash for the property. We strongly encourage having the proper amount of insurance in place.

The buyer assumes the cost of utilities on the day of closing on a house, thus he or she is responsible for establishing his or her own account for all utilities prior to that date. The Realtor can help with which companies to contact for services such as water/sewer, electric, cable (or satellite TV), telephone/ internet, and if applicable, natural gas or propane.

Also, if the buyer wants to continue using service providers that are in place for things such as pool cleaning and lawn care, these parties can be contacted as well to set up a new account.

By contract, the property is supposed to be maintained by the owner/seller until the day of closing. Usually, lawns are mowed and pools cleaned just prior to the closing day.

Don’t forget that you will need a photo ID at closing. Most of us carry one with us. But it would be silly to have to delay the closing because you didn’t bring one.

With increasing ease of travel and technology, closings are becoming less and less of an “event” done at a scheduled time and location with all parties in the same room. Many times sellers and buyers are signing documents on different days and at different locations, including anywhere around the world.

Your closing can be conducted by email and mail if you can’t be present. It’s also worth noting that U.S. embassies provide notary services for foreigners.

The closing itself will be run by a closing agent or real estate attorney. His or her job is to ensure that you understand each form you are signing.

Whether you as the buyer or the seller, choose the closing agent varies by county and can be negotiated in the contract.

If you are present at the closing you will possibly meet with the sellers (unless they have completed all the documents by mail), both Realtors, and often a real estate attorney to sign a huge mountain of paperwork, (unless of course, it is a cash transaction- which is far simpler with fewer papers to sign).

By the time you wade through and sign it all, you’ll be the proud owner of a title, a mortgage, and some shiny new house keys. This is important if you are not going to be present for closing, to determine where and how you will receive the keys and remote(s) for garage doors, gated entries, etc.

The fees for the closing agent’s work are included in the title insurance costs and are set by the State of Florida.

In addition to the closing statement, here are some of the most important forms at closing for the buyer:

The piece of paper that officially transfers the title from the seller to the new owner. Florida is a title state, which means that you, rather than the lender, hold the title to the property.

There are numerous documents lenders require including the Mortgage Agreement, Truth in Lending Statement, and Promissory Note.

The time you spend at your closing is largely defined by whether you are paying cash or financing. In the cash scenario, you’ll probably spend less than 30 minutes at your closing.

If you are financing, the process is more time consuming as there are many financial and legal forms. You can spend around an hour working through all the required forms and signatures.

Closing day is a big and exciting day! We hope that by offering you a general idea of what to expect, we are able to help make that day just a little less stressful and a lot more fun. Remember that this day is going to affect both you and your family for a long time to come, so take your time and ask questions about anything that may be unclear to you.

As always, you are encouraged to be diligent about seeking professional advice tailored to your own particular circumstances so that your closing day can be a pleasant opening of a brand new chapter…

And when you have signed the last document, you can exhale and start enjoying your new Sarasota residence.

Schedule a free 20 minute Sarasota real estate orientation video conference by selecting a date in the sidebar.

One of the saddest and most regrettable results of the bursting of the sub-prime mortgage bubble was the high rate of distressed sales and foreclosures in Florida. The situation that ensued was a sad reality that many people over the last many years were forced to lose their homes.

The climate has changed dramatically as of 2016. However, we would be remiss in our duties as agents and brokers, if we didn’t highlight the investment opportunity presented by these types of sales.

While the aftermath of the bubble has been highly unpleasant for millions of property owners, it did bring real estate prices down considerably. However, this process also had a pendulum effect with considerable overpricing on the way up and overshooting the bottom on the way down.

If you were a Buyer in the market right before, at the bottom, or shortly thereafter you were the beneficiary of pricing that may have been more reminiscent of the late ’90s rather than 2011-2013.

In 2012, Florida topped the list of states with the highest number of foreclosed homes. Now, in this first half of 2016, Florida is 5th in the US in the number of foreclosures. This is still well above the US average which means there are still some good deals to be found.

Some areas of Florida have had a long road to recovery. These include Hillsborough County in Tampa, and Polk County, which is between the cities of Tampa and Orlando.

In April 2016, about 15% of total sales in Hillsborough County and 16.9% in Polk County were distressed properties.

Otherwise, the number of distressed sales in Florida has decreased significantly. The three biggest contributors to this are:

In 2016, the discounts that had existed with a distressed sale have also drastically decreased. While a small discount does still exist, the pricing of a property is much more about property condition than if the seller is a bank or a private individual.

However, median prices in Florida are still below their peak. Recovery rates throughout the state vary, differing from city to city or even at opposite ends of the same street. Generally, the decrease in foreclosures and distressed sales is a combination of a property owner’s personal financial situation and the housing market in their neighborhood.

Though it’s another sad reality, an added effect from the increase in people who no longer own their own homes, is that a larger demand for rentals is created. This presents an opportunity for investors looking for a return on investment.

International and Domestic Buyers have purchased a great share of distressed properties over the past several years for the purpose of establishing rental income from those properties.

While the opportunities in this sector are present, and in many instances a great way to achieve value, it is important to understand both the intricacies and the process of foreclosures in Florida if you are going to go this route. It is also critical that you have an excellent Realtor representing you, one who understands fully and completely the tricky nuances of the distressed sale process.

If you are currently looking for a Realtor, we provide a thorough article on what you need to consider in our article Checklist for Choosing a Licensed Realtor in Florida.

Many people seem to think that bank-owned and foreclosed homes are often not included in the MLS listings. This is generally not true, most ARE included, but they may not show up for a while after the lender takes repossession of the home.

There is a convoluted process the bank has to go through before they release a distressed property onto the market. This includes allocating an asset manager to be responsible for the property and stabilizing the property so that its value is maintained. Typically this can take up to a few months before the property is listed on the MLS.

Foreclosure is the legal process whereby a homeowner’s rights to a property are forfeited due to the failure to maintain mortgage payments. If the homeowner is not able to pay off the outstanding debt or sell the house in a short sale, the lender will attempt to recover the balance of the loan by putting the property up for auction. If the property does not sell at auction, it becomes the property of the lender.

The process of foreclosure in Florida begins with the failure of the homeowner to make timely mortgage payments. This may be because of personal economic hardship such as the loss of a job or divorce. Or it may be because the property is “underwater”, meaning that the terms of the mortgage exceed the value of the property, and the homeowner intentionally decides to default.

It is typically after three to six months of missed payments that the lender will file a public notice with the County Recorder’s Office stating that the homeowner is in default. In Florida this notice is called a lis pendens which is latin for “suit pending.”

The homeowner will then receive a foreclosure notice from an attorney or law firm representing the lender. This notice is to inform the homeowner that the foreclosure process has begun and that they are in danger of losing their rights to the property and may be facing eviction.

In the state of Florida, the foreclosure process begins the moment the homeowner receives the foreclosure notice.

Pre-Foreclosure is essentially a grace period during which the homeowner is given time to respond to the foreclosure notice. In Florida, this period is generally within 20 to 45 days of the date that the bank served the notice.

During this time, the homeowner may choose to pay the outstanding balance or arrange to sell the property via short sale. The borrower can prevent the foreclosure by paying in full the amount owed to the lender before the date of the foreclosure sale.

If there is no response to the court action within the time specified, then the borrower can be found in default and the foreclosure process will continue. The lender would then ask the court for a final ruling. If this goes in the lender’s favor, the ruling will show the total amount owed to the lender, and the date for the sale of the foreclosed property.

The sale date is usually around 30 days after the court ruling is put in place. The notice of sale is recorded with the County Recorder’s Office and a notification will be sent to the homeowner. The notice will also be published in the local newspaper and the municipal website for a prescribed amount of time, the final notice appearing at least five days before the sale date.

The sale is normally held in the county courthouse and/or online. Because of technology it has become easier to buy in this fashion, yet there are cases where there is little or no due diligence period, so this process is only for the savvy buyer who has a team in place to do fast due diligence prior to the sale.

We have had clients who have clicked “buy now” on a property online and ended up with something which was not what they intended or expected, or worse than that had title issues because there was another lender making claim on the property.

The bidder who wins must put down five percent of the property’s value as a deposit, with the rest due by the end of the day. If this falls through then a new sale is arranged a minimum of 20 days later.

After a successful sale, the winner is given the certificate of sale, and the ownership of the property is transferred within ten days as long as there is no dispute on the sale. The borrower has no way to redeem the property after the certificate of sale is issued.

If the property is not purchased by a third party at the foreclosure auction, the lender then takes ownership and the property becomes a bank-owned property. The bank then may sell the property either by listing it with a local real estate agent on the open market or they may choose to sell it at a liquidation auction. Liquidation auctions are typically held at auction houses or large convention centers.

No one can really predict how long a foreclosure will take as each individual circumstance is different. In 2012, when Florida was the state with the most foreclosures in the country, the process could take 24 to 36 months.

In 2013, as foreclosures continued to clog up the Florida courts with both their numbers and the length of resolution, a new foreclosure law was passed (House Bill 87) and signed by the Governor. This has helped to speed up the process, but, because the process is complex and each situation will vary, it is still nearly impossible to predict just how long any given foreclosure in Florida will take.

All in all, for those who are determined and steadfast, the opportunities for foreclosures in Florida are still available. Misfortunes happen even in the best of times. And those willing to persevere can often find a great property at a reduced price. Whether you decide to pursue a distressed property or a standard listing, we always recommend that you have a well-equipped agent on board to help you navigate the waters in search of your new Florida Home.

Schedule a free 20 minute Sarasota real estate orientation video conference by choosing a date in the sidebar.

As we mentioned in our article on Florida Foreclosures, the bursting of the sub-prime mortgage bubble resulted in a sad and regrettable reality as the state of Florida topped the list of states with the highest rates of foreclosures and short sales. The situation has been dire for many homeowners over the last many years as they were forced to lose their homes.

Although the climate has changed dramatically as of 2016, we would be remiss in our duties as agents and brokers, if we didn’t highlight the investment opportunity presented by these types of sales.

While the opportunities in this sector are still present, and in many instances a great way to achieve value, it is important to understand both the intricacies and the process of Florida short sales if you are going to go this route.

It is also critical that you have an excellent agent representing you, one who understands fully and completely the tricky nuances of the distressed property sale process.

In Florida short sales the local knowledge and experience of your Realtor becomes even more important; in fact, it’s critical to the success or failure of the deal. Your choice of agent will ultimately determine whether or not you get your home. They need to have the experience and skill to know exactly the true value of the property, and what it’s worth to you.

For our business and any small business with integrity, it’s all about the people you have onboard and the relationships you build. Nowhere is this more true than in a short sale situation.

The key difference between a short sale and a foreclosure is that in a foreclosure the bank takes ownership of the property and forces its sale to recover losses. A short sale, on the other hand, is a delicate negotiation between the property owner and the bank or lender to recover as much as possible from the property’s sale to be paid towards the loan owed to the lender.

A short sale, or deed in lieu of foreclosure, can be defined very simply: where the property sells for less than is owed to the bank. This becomes an option when there is a hardship that requires the sale of a property and the homeowner does not have the ability to pay the difference between the net proceeds from the sale and the amount owed on the mortgage.

Essentially, the Buyer is asking the lender to accept less than is owed on the property and forgive the borrower the difference on the loan, agreeing to a “short” payoff. This decision is down to the lender and it requires a lot of paperwork and appraisal to get that decision made.

We detail what you need to know about standard property purchases in our article “Your Ultimate Guide to Buying Florida Property in 8 Easy Steps.” Please visit this article for more information on completing the property-purchase process.

To illustrate the challenges in dealing with Florida short sales, we share the story of a property we had listed for two years in a depreciating market. Initially, we had a buyer willing to buy the house for $1.2 million, but the lender was not ready to accept it.

Fast forward 15 months and the lender took 280,000 dollars (23 percent) less. Why? In this case, the first Buyer was ready willing and able, the Lender had all of the required info to make a decision, the appraisals supported the offer, but the Lender was not ready to take the loss on the loan and release the Seller (Borrower) from any further liability.

15 months later we worked with a negotiator at the same lender with years of experience who is paid for performance. The difference: We went from contract to closing in 60 days for 280,000 dollars less. Like all things in life, a short sale is all about the people. In this case, the Lender actually wrote off (took a loss on) the additional $280,000 and released the Borrower from the additional monies.

Florida short sales can go through as quickly as 60 days, but more typically take up to six months. The buyer has to be prepared to wait out the process as the bank and the seller hammer out the details of what the lender is prepared to accept.

Like any real estate deal, a short sale is all about the people. Make sure your Realtor has a lot of experience with Florida short sales. An experienced Realtor will keep the deal on track by being persistent and negotiating constantly with the lender or seller’s agent. That relationship is absolutely critical to the success of a short sale. Your Realtor also needs to have intimate knowledge of the local market to know the true value of the home.

The percent of Florida short sales has decreased dramatically since 2009/2010. While there are still opportunities, they have become much less prevalent. On one hand, that means fewer “deals” to find, but on the other hand, it is a signal that the local real estate and local economies have experienced a solid recovery.

Because the Florida real estate market is currently strong, it is even more important to make sure that you have a qualified Realtor advocating for your best interest as you explore the possibilities available for your glorious new Florida Home!

Schedule a free 20 minute Sarasota real estate orientation video conference by choosing a date in the sidebar.

Today I am standing on the pier in front of 800 feet of pristine waterfront on Longboat Key that will soon be home to the newest St. Regis Luxury Resort and Residences. There will be just 69 residences on this historical location.

This land was first developed as The Colony in 1952 by local developer Herb Field. In the late 1960s Merv Klauber, an orthodontist from Buffalo, expanded the development. The Colony Beach & Tennis Resort introduced multiple generations of families to Longboat Key. Having grown up on Longboat Key myself, I fondly remember the decadent Sunday Brunch Buffet with the dining room sitting right on the sand.

John Astor, an inventor and entrepreneur, developed the original St. Regis in New York in 1904. He named it for a 17th century monk who was well known for providing great hospitality to travelers. Now the next in the St. Regis collection — one of only 46 around the world — is due to be completed here in late 2023.

So, will our community be ready for a property of this stature? I want to take a look at this quarter’s numbers for some insight into what’s going on in our market.

There have been HUGE gains in our market when comparing the 3rd quarter of 2019 to this same period in 2019. Part of the gain is a result of pent up demand with transactions being deferred 1-3 months due to the pause in our market this past spring. Another part of the growth is that Sarasota offers the remote worker, the 2nd home buyer, and the earlier-than-anticipated retiree the ability to start enjoying life immediately especially in today’s climate.

Let’s review the numbers and put them in context:

It is this last indicator which makes me believe that the St. Regis — with its marquee location and phenomenal setting — will do very, very well. In fact, of the 69 residences, over half of the units are already sold. Our market still has very few, truly distinctive developments with settings that can’t be replicated.

💡 Already 50% sold!

Request a virtual or in-person presentation @ 941.587.0740.

So, if you want to be part of this great beachfront community, then it is time to ACT! The property will be completed in late 2023. When you are ready for a virtual or in-person presentation about the lifestyle you will enjoy here please give me a call and we will arrange it immediately.

Looking forward to being on the beach with you soon!

This month I want to start the conversation by focusing on Sarasota property owners who may be potential sellers. If you are contemplating selling for any of the following reasons, I want you to listen closely:

Sellers, there’s tremendous activity right now in the Sarasota market so if you’re ever going to consider selling, now may be the best time to do that.

To illustrate how dramatic this activity is, I looked at two statistics:

Our community has done a great job of pivoting for its residents. Whether you’re isolating at home or you’re going out and about, there are services and amenities to meet your needs. The arts and culture of our community have many programs that have gone virtual and our grocery stores and restaurants are working hard to deliver your favorites to your personal residence.

And if you are an out-and-abouter, almost everything is open. Marie Selby Botanical Gardens is open, the Ringling Museum is open, the Sarasota Art Museum opens October 1st. You can go virtually anywhere and experience our great life.

In just a few short weeks, places north of Sarasota are going to begin to get colder. Where do you want to spend this winter when it’s cold, icy and gray outside?

I invite you to give me a call @ 941.587.0740 to discuss your real estate strategy.

What’s happening where we live here in Sarasota? First, we’re seeing the median price continue to go higher and higher for the last four straight months. It’s now about $296,000 for a home here in Sarasota. Second, interest rates are very, very low. Currently, if you borrow the maximum for a conforming loan — that is about $510,400 — at the current rate, your payment is approximately $2,085 a month. This is incredibly inexpensive. Those who have the ability to pay in cash still may choose to borrow so they can leave their money in their other investments because the borrowing rate is so low. In fact, some people believe that the interest rates are actually negative when you factor in inflation.

Sarasota is still a great attractor — perhaps even increasingly so as the current state of our world is a catalyst for people to evaluate where and how they live. This is a great 12-month destination for people who want to spend time in warm weather and outdoors. Whether it’s boating, golfing, playing tennis, pickleball, walking, running, or biking, it continues to draw people from all over the world.

There are two types of buyers right now: Migrators and Switchers.

Whether you are a switcher or a migrator, there are lots of good opportunities to find the property that best matches your lifestyle. New inventory is being created daily from the new construction of single-family homes and condominiums as well as the properties that switchers are vacating.

In fact, just today one of my favorite properties in all of Sarasota came on the market – Casa del Carnevale. It is 171 feet on the open bay on St Armands Key. This is just the third time it has become available since it was originally created in 1936.

We cannot control the world in which we live, however, we can control where we live. Whether you are a Migrator or Switcher call me @ 941.587.0740 when it’s time to sell, buy, and live well here in Sarasota.

We offer the highest level of expertise, service, and integrity.

The Investments In Sarasota team has the most depth of experience, training, and education in the local real estate market. With our concierge-style service, we support and protect our client’s interests to levels far beyond the industry norm. The rave reviews from our clients say it best.

We Know More. We Care More. We Do More.

Contact Us

Investments In Sarasota

15 Paradise Plaza #189, Sarasota, FL

Sarasota Real Estate Broker